Good morning,

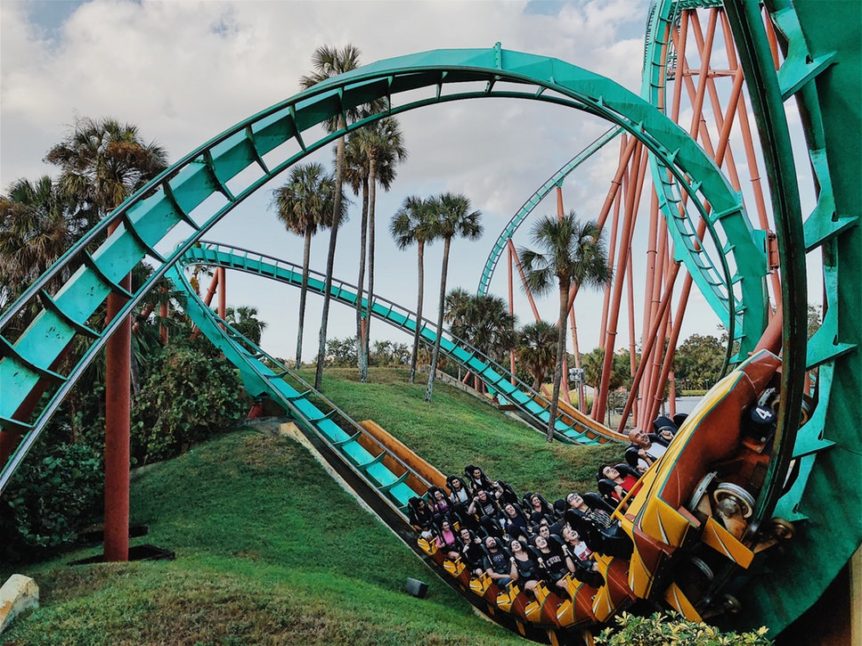

The stock market is continuing on its “roller coaster” ride, and it is not the kiddie roller coaster. In the last three weeks respectively, the benchmark Standard & Poor’s 500 Index has been down 3.8%, up 4.8%, and down 4.6%. As you can imagine by those numbers, there are some big picture issues driving the volatility.

Headwinds for the market include worries about global growth, U.S. – China trade tensions, and Federal Reserve interest rate policy. Some investors have been concerned the Fed may be raising rates too much, too soon. However, the Jobs Report released last Friday seemed to be “just right” and alleviated some of that concern.

The United States Department of Labor reported the economy added 155,000 jobs last month and that the unemployment rate held steady at 3.7%. Over the year, average hourly earnings grew by 3.1%. In total, the jobs report was positive but weaker-than-expected (as the market was expecting job gains of about 190-200,000). So the number “threaded the needle” in so far as it showed a healthy labor market, but was not so hot it would signal the Fed to aggressively raise rates.

The Fed’s next meeting is December 18-19 and according to the CME FedWatch tool, there is a 73% chance of a ¼ percent rate hike. Beyond that, the market will be very focused on what the Fed’s thinking is for next year – and that will be a major factor influencing the roller coaster.

All the best,

Southport Station Financial Management, LLC